As we edge in to 2024 and prepare for another year in print, LFR sits down with some of the leading voices in the industry to discuss what we can expect over the coming year and how print service providers can prepare for the major trends that will likely come our way over the next 12 months.

Despite the ongoing economic uncertainty that hangs over almost every industry, print persevered over the past 12 months, with 2023 proving to be another busy year for the market. Demand for paper-based marketing was on the rise; window, wall and floor graphics continued to dazzle passers-by; and wide-format print again proved an integral part of innovative outdoor campaigns.

There was plenty to be positive about in 2023 and, given some of the major trends that emerged and will likely carry over into next year, this momentum looks set to continue. Add in further trends that will appear in 2024, and there is plenty for print service providers (PSPs) to get excited about as we move into the New Year.

But what can we expect over the next 12 months? What key areas should PSPs be looking to target and how can they best go about preparing their business, so they are in the strong position possible to address these trends and capitalise on new opportunities?

LFR gathers around print’s crystal ball with a few industry friends to look ahead to 2024 and predict some of the major trends that could be heading our way…

Standing still is not an option

Yucel Salih, Wide-Format Sales Specialist at Ricoh UK, kicks off with a simple yet effective piece of advice: standing still is not an option for PSPs. Salih said that while investing in new technology is obviously a must for companies seeking to move forward and evolve, PSPs should also look to invest in a partnership with a trusted supplier so that they can fully address changing trends.

“The technology and solutions to achieve great results are out there but matching the solutions to application creativity and execution will be the difficult part,” Salih said. “This is why when investing in new technology, PSPs should also be investing in the partnership with the supplier of that solution.

“Are they and their support here to stay? Are they innovating in my market sector? Can they help with business development and testing of new applications throughout the life cycle of the system? I find that more and more PSPs are tending to look for application business partners, working in unison, more so than just hardware suppliers. These are additional factors I would see PSPs considering when investing.

“I can see attending showcases and print shows in 2024 being very important in finalising PSPs’ plans for the future to add confidence that the direction they are taking is the correct one.”

As for what stood out for Ricoh in 2023, Salih said there has been a shift to clients looking for the most cost effective solution that has the biggest impact but at the right price. Salih said while this may sound easy and obvious, it is actually hard to achieve.

“Budgets for marketing print spend have stayed stagnant or even decreased but costs have increased significantly, therefore getting the same amount of work out of a tight budget is a major challenge for the PSP,” Salih said. “This has led printers with the task of reducing costs as much as possible to stay competitive but still profitable.

“I would say that understanding applications has never been more important than now as well as understanding the latest technology and solutions to achieve the same output but at a lower cost. The print industry is doing a lot of investigating into solutions that make creating applications easier and reducing cost. If PSP is not ready yet to invest in the latest technology or taking the leap of faith and playing it safe for the time being, I see their efforts being spent on gathering facts and making the ultimate decisions on where to take their businesses into the next chapter.”

Salih offers up the example of traditional screen printers finding small batch work troublesome to stay competitive, as unit costs have increased significantly but are reluctant to turn business down so are migrating to digital solutions for the low quantity runs. Salih said this also includes garment print where heat transfer printing was deemed as a suitable solution, but the cost of raw materials and time taken to prep and finish heat transfers led traditional printers to investigate direct to garment (DTG) and direct to film (DTF) solutions to stay competitive.

Evolution is key

Another major manufacturer weighing in is HP. While HP expects the large -format printing market to continue to grow at a steady rate, with technology adoption and new application innovations powering progress, there are some trends that, if approached in the right way, offer opportunities for PSPs to thrive.

Perhaps unsurprisingly, first up is automating workflows. HP said with 80% of businesses worldwide automating processes, automation is increasingly important as organisations continue to navigate macro issues such as labour shortages.

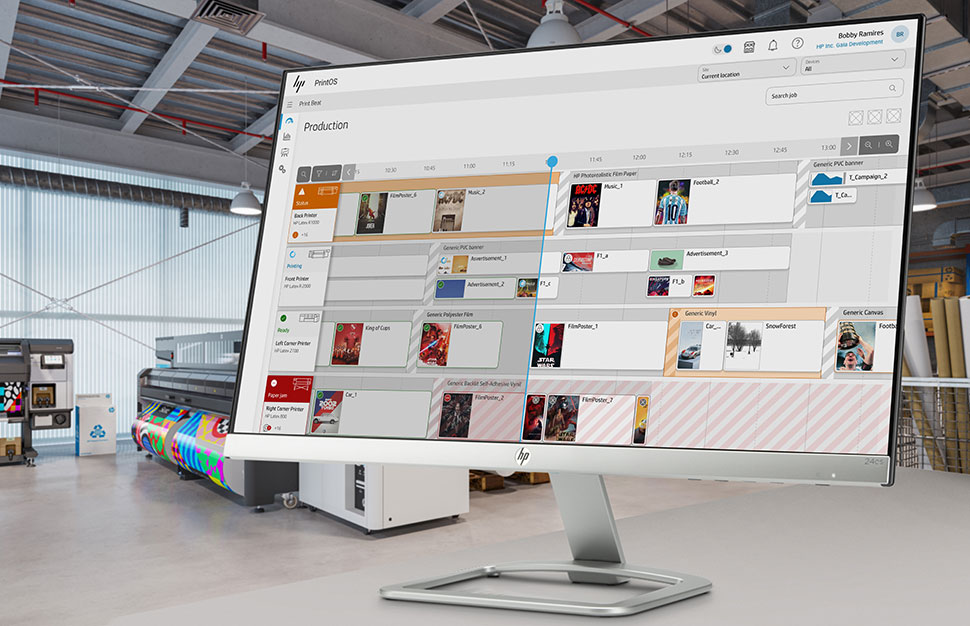

Mike Boyle, Global Head of Large Format Go-To-Market, HP “As businesses run digital presses on a 24/7 basis, we expect to see a greater uptake of automated services, and the arrival of new tools to better meet PSP needs, by running businesses and print jobs through platforms like HP Print OS, print firms can unlock previously unseen efficiencies – such as through data analysis of operations, unattended printing or removing repetitive and time-consuming processes.

“Automation also boosts the speed print firms can operate at, improves the accuracy of projects, and identifies errors - enabling PSPs to find new ways to streamline operations.”

Also flagged by HP is sustainability, with the manufacturer highlighting research that suggests 85% of PSP customers now demand sustainable products and practices. According to HP, increasing demand for more sustainable goods reflects a consumer shift in values and awareness of the planet’s health.

“Print firms will continue to recognise this in 2024 and embed sustainable practices where possible,” Boyle said. “For this reason, water-based and odourless inks will be sought after, allowing print professionals to say yes to a wider range of jobs, including sensitive indoor environments. The fact more than one in five printers sold in the large-format market is an HP Latex device, is proof that this trend is already well underway.”

However, HP went on to say that printers will need to look beyond ink and consider how substrates can be procured and disposed of in a sustainable way.

“Although progress has been made, the industry must continue to find alternatives to materials such as PVC by investing in new media and research to discover and elevate sustainable solutions.”

As for work trends, HP points to personalisation, saying this offer PSPs the change to differentiate from the competition and grow. The manufacturer cited research by Sparks & Honey, which said the expected value of the personalised items market will reach $201bn by 2026, up 49% from 2021. Meanwhile, 70% of shoppers are willing to pay at least 10% more for customised or unique products.

“We are seeing creative platforms such as Canva increasing end users’ design capabilities, giving them more ways to personalise print products such as wallpaper,” continued Boyle. “We recently released a trends report which highlights that the digitally printed wallpaper market is predicted to grow at an annual rate of 23.6% until 2025, reaching a total value of $10.4bn.

“Brands will increasingly base their marketing strategies around ‘user-generated’ or ‘co-created’ content - campaigns that tell the stories of their customers and speak directly to them. With the right technology, print firms will be the enablers of this growing trend, and become trusted partners for brands.”

Boyle concluded: “Print businesses have been evolving year on year, and turbulence in recent years has only accelerated the pace of change. Large format print providers are displaying resilience and creativity, and the industry will continue to thrive this year in a more connected, automated, sustainable and secure environment.”

Materials will matter

Equipment forms just part of the equation with trends also shaping and impacting the type of materials that PSPs are working with. Mark Mashiter, Group Managing Director at Soyang Europe, said this is certainly true when it comes to the subject of sustainability. Environmentally friendly materials and solutions are now at the top of the list of requirements for many customers, with this trend almost certain continue not just in 2024 but for many years to come.

“We can expect some retail companies to embrace the use of textile using recycled yarn, which is PET bottle yarn from plastic bottles recovered from ocean waste,” Mashiter said. “Soyang has the Global Recycling Standard (GRS) and has developed a whole range now from recycled content, opening up all a whole range of options to our customers.

“Also available from Soyang Europe is the Solar PVC-free range of materials. These products have been gathering momentum on a number of areas in recent times, especially within the sports and events sector, where previously huge amounts of PVC were being used.”

Away from the all-important subject of sustainability, Mashiter said one other major trend that has stood out to Soyang Europe over the past year has been a lean towards more textile graphics. He said this has been apparent across a range of sector and looks set to continue into 2024 as demand grows for these applications.

Set for superior sustainability

Away from manufacturers and suppliers, what do those working on the front-line think? Nathan Swinson Bullough, Managing Director of wide-format print and signage business Imageco, also said sustainability was high on the list of priorities in 2023 and this is continuing to grow, “not just from a machine perspective but encompassing the whole operation of PSP’s carbon reduction, waste reduction”.

Sustainability aside, Swinson Bullough said print technology is continuing to evolve, enabling more creative possibilities and exciting opportunities for PSPs.

“The ‘pile it high sell it cheap model’ I feel is failing; with rising costs of material and an ever more competitive market, it is becoming difficult to sustain this,” Swinson Bullough said. “I believe what we have seen in 2023 will continue to develop and I think creativity in print will continue to flourish.”

Imageco is well placed to deal with such a trend, having recently installed a Swiss Q Nyala. Swinson Bullough said technology like this allows companies to enter new markets and offers potential to be different while maintaining productivity where needed.

Looking ahead, Swinson Bullough said: “I think we will see an acceleration in material development from a sustainability standpoint, much work needs to be done in this field along with the circularity of products and waste management.

“Awareness of these problems are accelerating thanks to what the likes of FESPA UK are doing and Make it Happen on their training courses. A general thirst for knowledge is apparent out there now and those that embrace sustainability and make the change will benefit.”

Swinson Bullough is a member of the FESPA UK board and his colleagues at the trade organisation also have words of advice for those planning ahead for next year. Paul Noble, Vice President of FESPA UK and Managing Director of Specialised Canvas, said investment in productivity is a must if companies are to grow over the coming 12 months.

“Doing business in 2023 has been a challenge to find and retain the required skills,” Noble said. “We have also seen a further shift to customers specifying materials with recycled content and better end-of -life possibilities, even if there is price premium.

“Looking ahead to 2024, we expect the effect of cost pressures to continue to squeeze margins. As growth will continue to be hard to find in a flat economy, businesses must invest in productivity to support their plans.”

Spend money to make money

This focus on investment is shared by Andy Wilson, Managing Director of PressOn. Wilson said he believes the industry will see higher levels of investment in 2024 as companies seek to enhance their offering and deliver a wider range of services to their customers. This, he said, is certainly true of PressOn and its own strategy.

“I think we can expect increased investment coming into the print market as a whole,” Wilson said. “We are also looking forward to lower interest rates, which we can expect in the first quarter of the year.

“At PressOn, we are maintaining our investment program; we believe the investment program of our customers will be more prolific, and therefore we expect even more work to come in because of that.”

There is reason for even more excitement at PressOn, with the company set to launch a brand-new venture in January in the form of PressOn Automotive. Developed in partnership with Metamark and HP, the new business will deliver vehicle branding, protection and colour changing from a purpose-built location.

Wilson said PressOn has noted an increase in interest in this sort of work and having been impressed with what the team saw at the debut edition of FESPA WrapFest earlier in 2023, PressOn felt the time was right to take the plunge and launch the new venture.

“We think this sort of customisation and protection market is a big growth area,” Wilson said. “It has been around for a while, but we think following contributions from influencers and YouTube stars, and how this has raised awareness of these applications, makes it the ideal time for us to go into it.”

While there are some differing views on what we can expect in 2024, the underlying trend here is that of positivity. There is seemingly plenty to look forward to as we head into the New Year and by planning your path carefully, working with partners and listening to your customers, you too can capitalise on these trends and make 2024 a year of growth.